Tax cuts, major infrastructure projects and healthcare spending were among the big promises made by Treasurer Josh Frydenberg upon announcing his first Federal Budget on Tuesday 2nd April.

With a promise to deliver a $7.1 billion “surplus” by 2021, this is what Frydenberg’s “Back in Black” budget means for you:

For Businesses

- Eligibility for the instant asset write-off scheme extended to businesses with a turnover of up to $50 million

- Instant asset write-off threshold set to increase from $25,000 to $30,000

- Proposed Division 7A (private company loans) amendments set to be deferred for another 12 months

- $1 billion in funding over 4 years towards the operations of the Tax Avoidance Taskforce targeting multinationals, large public and private groups, trusts and high wealth individuals.

For Individuals

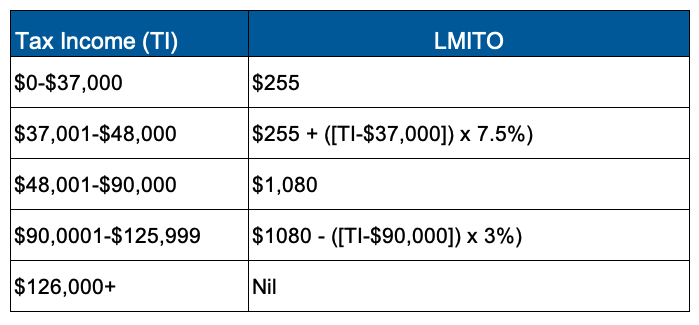

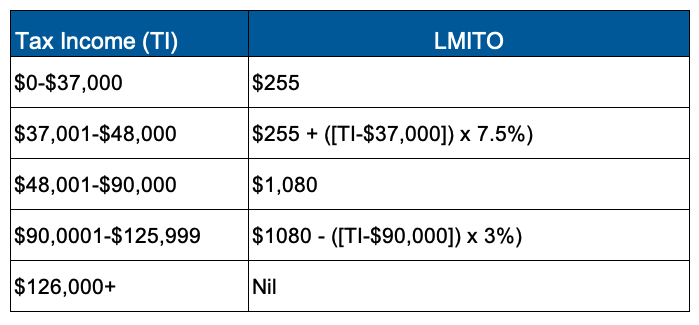

Low and Middle Income Tax Offset (LMITO)

- $158 billion promised for personal taxation relief through the non-refundable Low and Middle Income Tax Offset (LMITO) as per the following:

- Tax offset of up to $255 for taxpayers with taxable income of $37,000 or less

- Taxable incomes between $37,001 to $48,000 eligible to the offset at a rate increasing from 7.5 cents per dollar to the maximum offset of $1,080

- Individuals with taxable incomes between $48,001 and $90,000 set to be eligible for the maximum LMITO of $1,080

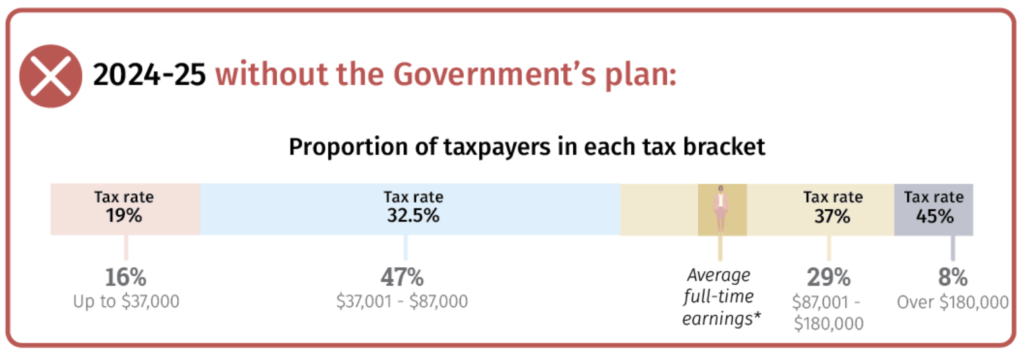

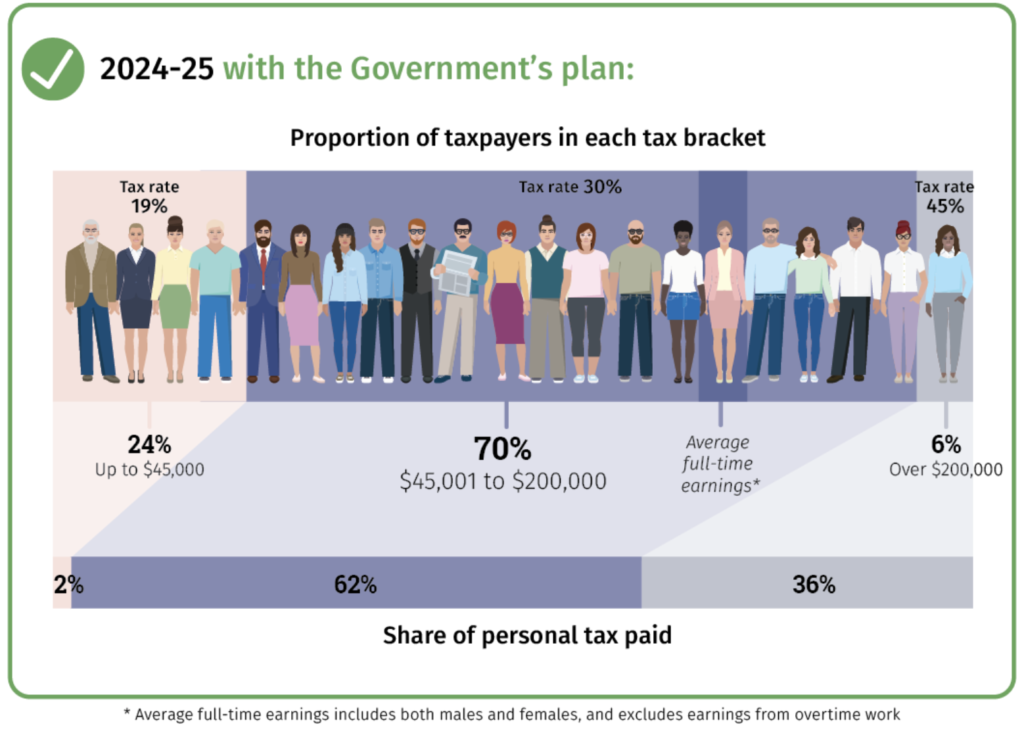

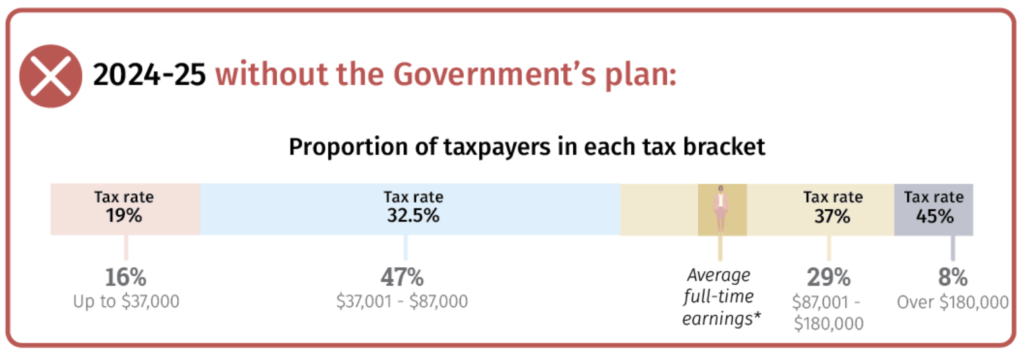

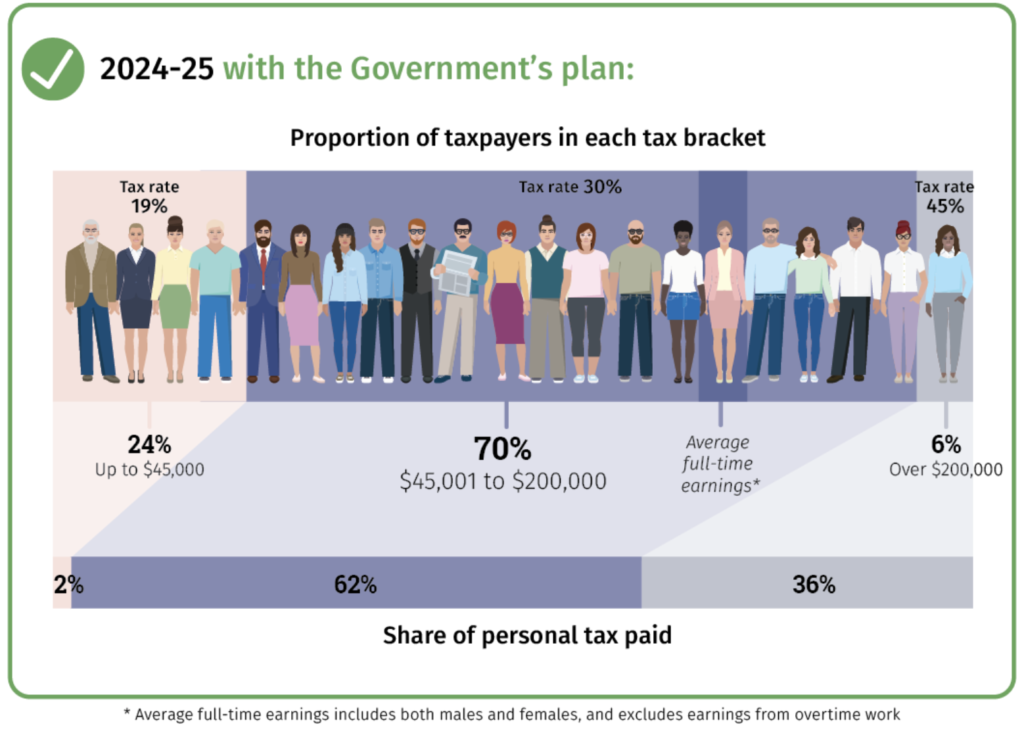

Proposed Income Tax Rates

- Proposed Income Tax Rates from 2024-25 will reduce from four income brackets to three:

- 19 cents in the dollar: up to $45,000

- 30 cents in the dollar: between $45,001-$200,000

- 45 cents in the dollar: over $200,000.

Sourced from Budget Paper 2019

Sourced from Budget Paper 2019

Superannuation

- Individuals aged up to 66 set to be eligible for exemption from the Super contribution work test allowing voluntary concessional and non-concessional contributions.

- This will bring the work test in line with the eligibility requirements for the Age Pension, which is set to increase to 67 from 1 July 2023.

Infrastructure

- $100 billion in spending has been promised over the next 10 years to align with the projected growth in population.

- What this means for you in Queensland:

- Additional $2.6 billion promised for projects including upgrades to the Gateway Motorway; and Logan Motorway.

Healthcare

- $81.8 billion pledged toward providing access to essential healthcare and medicines in 2019-20. Among the inclusions in this spending:

- $187 million towards more affordable access to 119 GP services; and

- $331 million towards new drugs to be included in the PBS over five years.

The catch is that the current government must be re-elected at the next Federal election in May. If you wish to discuss how any of these proposed changes may affect you, please contact our tax team.